Speeding Up Clean Ammonia in Shipping

For a speedy transition, partnerships are key.

The energy transition in shipping is driven by the climate crisis. The shipping industry is a core part of global supply chains but the market for refuelling ships is still dominated by fossil fuels, making emissions from this sector a challenge for decarbonisation.

The transition towards clean fuels in the shipping industry needs to increase for it to play a role in meeting global climate targets and to act as a catalyst for decarbonisation in other sectors, for example in the realm of technology development and hydrogen and renewable energy markets. The demand for clean fuels such as clean ammonia will support the investment required to increase their scale of production, which will also encourage investment in the mid- and down-stream legs of the supply chain – which is fundamental to achieve the transition.

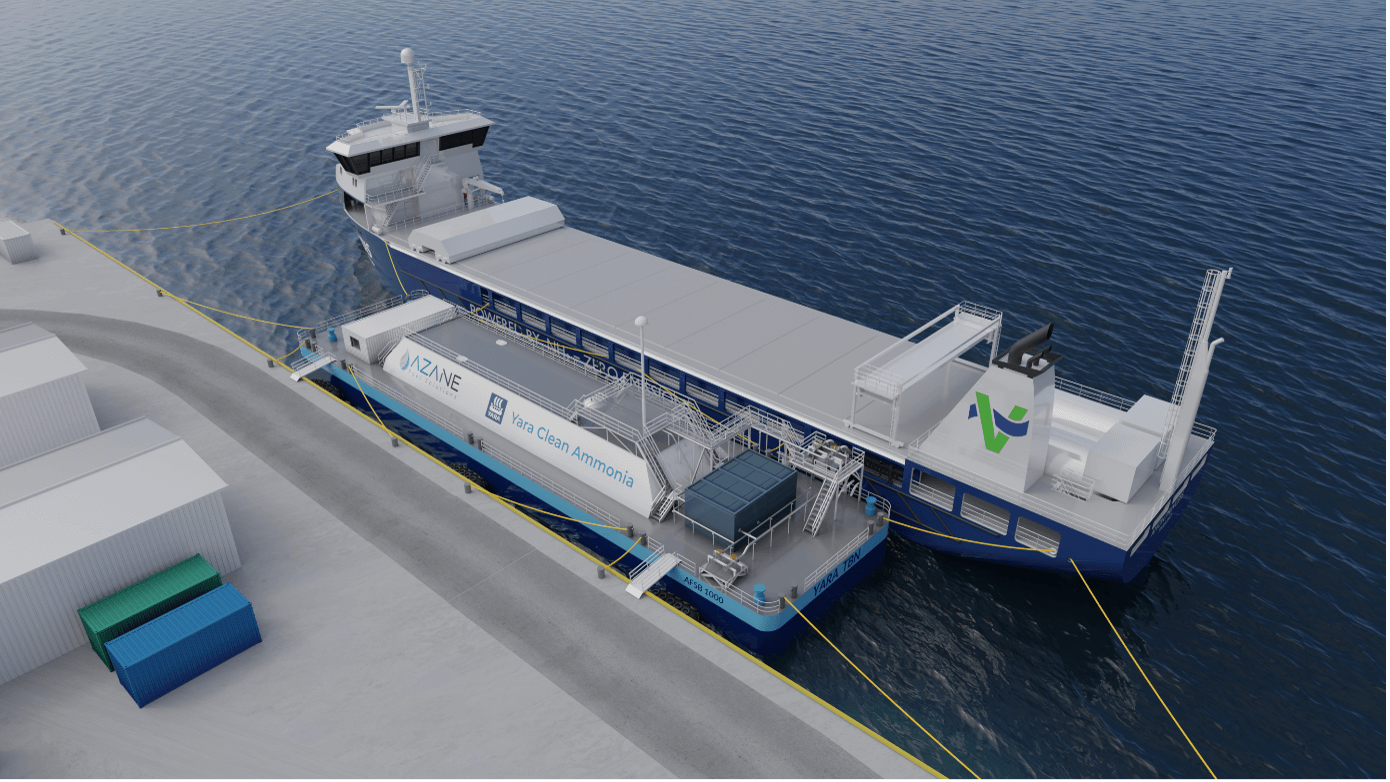

Today, Yara Clean Ammonia (YCA), a company capitalising on the existing global network of assets and customers of Yara International, is working to decarbonise its ammonia production plants as well as grow and build midstream and downstream operations to deliver clean ammonia to ships.

Value chain partnerships:

The energy transition involves partnerships on the supply and the demand side. Producers and distributors like YCA will be involved in both.

On the supply side, the current shipping industry’s global refuelling business is fragmented. The transition will involve partnerships to reduce the large risk profile of these investments and seek efficiencies in the supply chain driven by cost considerations and factors such as safety, technology, and business strategy considerations. An example is the Azane Bunkering Solution recently launched in Norway.

On the demand side, joint studies and collaborations with charterers and ship owners are fundamental to increase knowledge and the understanding of ammonia, its characteristics and risks, what it involves from a handling perspective to increase confidence that the fuel can be made available when and where it is needed. This can be achieved via joint initiatives but must also be the objective of ongoing business discussions. YCA is doing this by sharing information with stakeholders on activities related to its trade and shipping operations, for example.

Creating an enabling environment:

Partnerships between private sector players pursuing investments in the clean ammonia space are fundamental, yet these entities are faced with the same core challenge of uncertainties in demand. This barrier will be reduced to a great extent when the price of clean fuel and costs of operating ammonia-propelled ships compete with the price of fossil fuels.

As argued by the 2021 Green Ammonia Volumes analysis report published by Maritime Clean Tech and DNV, scenarios where this can be mitigated and reduced include policies and incentives. For example, blue ammonia with high capture rates (90%+) is considered a good alternative since it is expected to be cost competitive with grey ammonia with CO2-taxation between 2030-2035. Green ammonia, which has high capex costs as well as technology efficiency issues and faces competition for renewable electricity in grid-connected locations, will require support in the first years. However, this will change in the longer term as total plant capex comes down and efficiencies and load factors increase as the industry develops but will take time to become cost competitive without subsidies.

YCA and others are pushing to develop the market for ammonia as a clean fuel for the shipping industry by combining lessons-learned with forward-looking initiatives and partnerships to develop new solutions for the sector.